Make easy work of your finances with our ICAEW accredited accounting software

For over twenty years Khaos Control’s accounting software has been providing businesses across the UK with up-to-the minute financial reporting and advanced control over their accounts.

Keep control over your accounts with software that’s simple to use

Compliance and ease

Make easy work of submitting your VAT returns whilst remaining compliant with the UK’s latest regulations. Our solutions track all your sales and purchases, calculate their tax amounts, and whether you’re liable for a payment or due a rebate, the whole process is – simple and stress-free!

Real-time financial data

Our intuitive accounts allow businesses to stay on top of revenue, profitability, and have sight of all business expenses. We put the accounting information front and centre to aid in your day-to-day operations; this enables you to control the live processing of orders and reroute them if your customers’ accounting terms are likely to be exceeded. Live drill down in data by customer service staff can also make your operation slick and, at the same time, keep the customer happy with timely and accurate information.

International growth

The system provides multi-currency and multi-country support, which ensures businesses can expand their operations knowing that the system can easily handle expansion into new territories. Khaos Control products can output Customs Invoices, which include ICN and HC commodity code, making cross border logistics easy to manage. We also integrate with many different courier services, many of whom offer international shipping services.

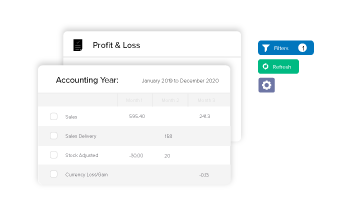

Powerful reporting

With Khaos Control hooked up to the data running through your business, you’re able to know the profitability around every item in your inventory, your most financially successful (and unsuccessful) promotions, as well as insight into where you should allocate your budgets. We can also offer insight in slow moving items which may be taking up warehouse space, with our “aged stock value analysis” report.

Other key accounting features in the system

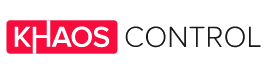

Trial Balance

View the balance of all nominal transactions used in any financial period. Drill-down in the double entry for each nominal account and trace journals back to their source.

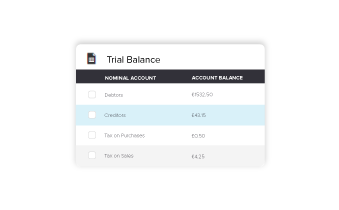

Bank Reconciliation

Make fast work of matching your bank your transactions with simple-to-use filters and export options. Includes integrations with the likes of PayPal and Amazon.

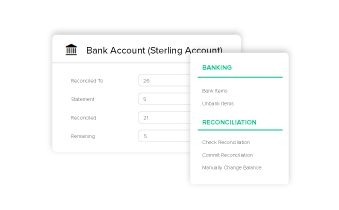

Tax Register

Stay compliant with your tax and submit your VAT returns to HMRC via their “making tax digital” portal.

Reports

Create a variety of reports to display key information about sales orders, purchases, customer returns and more.

Xero Integration

Spend less time on business admin with our built-in Xero integration. From exporting invoices to scheduling payments, connect your invoices, sales and expenses.

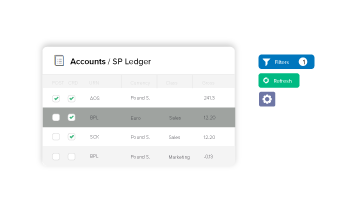

Sales & Purchase Ledger

Record every sale and purchase. Print customer and supplier facing reports, and process orders through to invoices, which are posted to your ledgers.

“Khaos Control has transformed our business! We moved from a well-known accountancy software, that was unable to meet our demands as a growing business, to Khaos Control. It’s helped us have a lot more visibility over our stock holding and our sales operations. Even six years later, we are still finding ways that we can work with the software to help streamline our business.”

Accounting software for every type of business

Small and midsized businesses

Whether you’re a retailer or wholesaler, managing your own books or working alongside a bookkeeper, Khaos Control Cloud provides an easy-to-use system to look after your finances. For a small monthly subscription, users can access accounting tools that work in combination with the other key features in the system.

Learn more

Large enterprises and organisations

If you’re selling on multiple ecommerce channels with stores and warehouses stretching across the UK, Khaos Control keeps all your accounts running through one system. As well as offering the highest level of security, our system offers hundreds of integrations, advanced accounting features, and the capacity to develop the system to the ad-hoc requirements of a larger organisation.

Learn moreTake your finances anywhere in the world with cloud accounting software

The power of cloud data means you can access your accounts anywhere with an internet connection, on any device. Instead of the hard drive on your computer, our system becomes your hub.

The nature of cloud technology means your data is encrypted and secure. Start accessing critical information with ease – whether it’s who owes you money, cashflow queries or what bills are outstanding.

Access to any mobile, tablet or device with an internet connection

Gain an immediate overview of your financial position

Multi-user access makes for collaboration easy between teams

Nothing to install with your data backed up automatically

Frequently Asked Questions

The nature of being a business owner means having to pay attention to detail, especially when it comes to your accounts. Accuracy means a better understanding of your figures, and automation normally means gaining a better insight into your numbers (without you having to do the analysis yourself).

So yes, we would always advise starting with free or basic accounting software package behind you, but if you’re comfortable and confident sticking to spreadsheets – keep going.

Check out our blog for a more detailed look at whether or not your business needs accounting software.

The nature of being a business owner means having to pay attention to detail, especially when it comes to your accounts. Accuracy means a better understanding of your figures, and automation normally means gaining a better insight into your numbers (without you having to do the analysis yourself).

So yes, we would always advise starting with free or basic accounting software package behind you, but if you’re comfortable and confident sticking to spreadsheets – keep going.

Check out our blog for a more detailed look at whether or not your business needs accounting software.

Yes! Our integration with Xero connects the key aspects of your business finances, including your invoices, sales and expenses, to Khaos Control. Learn more about our Xero integration here.