In 2021 the EU and UK are overhauling their ecommerce VAT regimes to simplify compliance and reduce VAT fraud. Come the 1st July 2021, the 27 member states of the EU will introduce reforms to the VAT obligations for B2C ecommerce sellers.

Put simply, if your business sells from a website, marketplace, or any other form of ecommerce channel, it’s your responsibility to understand your own obligations. If ignored, you run the risk of extra VAT cost and a bad customer experience.

VAT rules

As the VAT rules currently stand, no import VAT must be paid for commercial goods of a value up to €22. These rules are changing from 1st July 2021, meaning all commercial items imported into the EU from a non-EU country will be subject to VAT.

What key changes will take place after the 1st July?

- Online sellers can register in one EU Member state. This will be valid for the payment of VAT on all distance sales of goods and cross-border suppliers to customers in the EU.

- The current threshold around distance sales of goods within the EU will cease to exist. Instead, it will be replaced by a new EU-wide threshold of EUR 10,000. Below this threshold, the supplies of electronic, broadcasting and telecommunication services within the EU will remain subject to VAT in the Member State (where the taxable person is established).

- Certain provisions will be introduced to online marketplaces such as Amazon and eBay whereby these platforms are deemed for VAT purposes to have received the goods themselves.

- New recording keeping requirements will be introduced for online marketplaces, where such platforms are not deemed as suppliers.

- The VAT exemption at important of small consignments of a value up to EUR 22 will be removed. That means that any good imported in the EU will be subject to VAT.

- Measures for distance sales of imported goods in consignments not exceeding EUR 150 will be introduced, in case the Import One Stop Shop (IOSS) is not used.

What is the IOSS for?

The IOSS allows suppliers, who are importing goods to customers in the EU, to collect, declare and pay the VAT to the tax authorities; instead of making the buyer pay the VAT when the goods are imported into the EU. Registering for the IOSS scheme is optional, but the VAT changes which are coming into effect are not.

As of 1st July 2021, all B2C goods under the value of €150 will be subject to VAT at the point of sale. Shipments over €150 and B2B goods are not affected and will continue to be handled via your usual Courier/Import/Customs process.

The amount of EU VAT calculated will be dependent upon the final destination country. For example, shipping goods to France will mean the seller needs to apply French VAT rates, and shipping goods to Germany will mean the seller is required to apply German VAT rates.

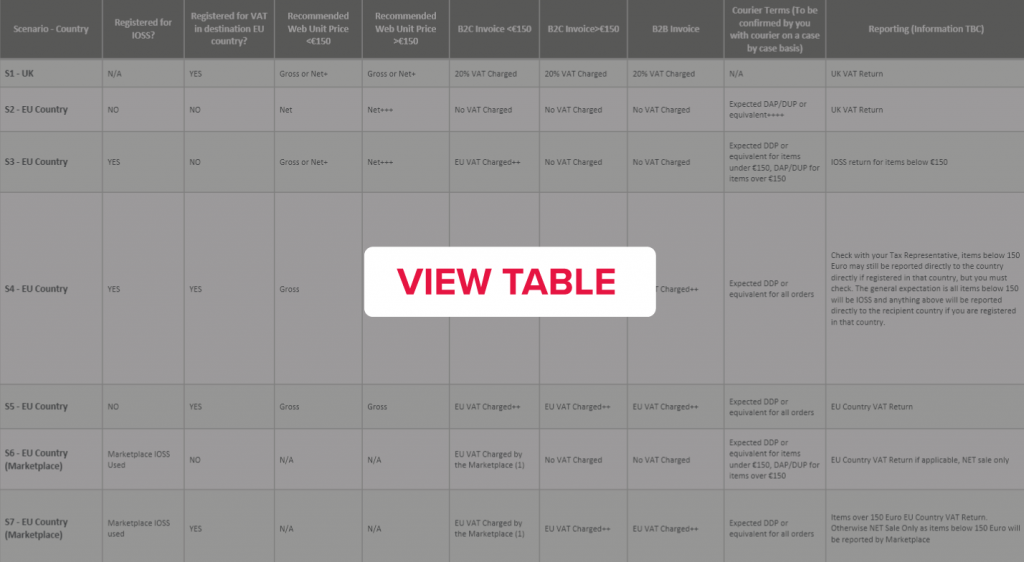

The table below is provided as a GUIDE only, and you must seek your own advice when it comes to aligning your business management software configurations.

What does this mean for Khaos Control customers?

This is a complex issue for all businesses, and it’s critical all our customers are reviewing and understanding their VAT and IOSS obligations as it applies to their own circumstances. As we continue to release updates across both platforms, we strongly recommend all our customers carry out the following steps:

1. Decide how you will handle your orders

In the first instance, you must decide how your business will be handling orders to the EU, and if you need to register for IOSS as a company. Once you do and once our IOSS update has been released, there will be a place in System Values where this information can be recorded.

2. Talk to your web provider

You will need to talk to your web provider about how they will be handling EU orders on your website.

- We cannot enforce, or provide tax information for web integrations, so this will be something you need to consider ahead of July 1st.

- We cannot provide TAX advice, and the rules that will apply to your business and order channel must be reviewed and considered independently, depending on your circumstances.

For orders coming in from a website (these scenarios are correct to the best of our knowledge however you must do your own research):

- If you are registered for IOSS:

– For orders under 150 Euro, orders can be provided with the Gross prices, allowing Khaos Control Cloud (once configured) to calculate the correct tax within those prices.

– For orders over 150 Euro, this will depend upon your business situation and tax registration status, on a per EU country basis.

– If you are registered for VAT in a particular country, it’s to our understanding that VAT will need to be calculated upfront for those orders. Using Gross prices will make this easier.

– If you are not registered for VAT in a particular country, it’s to our understanding that VAT does not need to be calculated upfront and will be collected at the border/ customs. This means the use of NET prices.

3. Ensure your marketplaces are configured

Ensure you have reviewed your marketplace usage and configuration. Also ensure you have captured suitable IOSS numbers for Amazon, eBay (and any other relevant marketplace) to then configure these in Channels 2.0.

- The IOSS numbers need to be in place ahead of receiving orders from the marketplace, so they can be stamped on the orders at the point of creation within Khaos Control or Khaos Control Cloud. (Once you have received an IOSS update, there will be a place to specify within the Channels 1.0 and Channels 2.0 configuration screens, an IOSS number per channel)

4. Review your EU Country VAT

Enable Country VAT in System Values so that European VAT rates for use by Khaos Control or Khaos Control Cloud can be configured.

- Review your Country VAT configuration on a per-country basis for all EU countries.

- Configure the EU VAT rates for countries you expect to handle orders for. This is required even if you only handle orders from Amazon.

- Review your Country VAT configuration on a per-country basis for all EU countries.

- If you’re registered for VAT in a specific EU Country in addition to any IOSS registration, ensure that your EU country VAT number is recorded against the country in the VAT reference [future update].

- Review with your accountant and countries where you are registered for VAT and if you need to be charging VAT (even if over the 150 Euro threshold for B2C and B2B orders).

– If for any reason you are registered for VAT in a country but DO NOT plan to charge VAT on orders over 150 Euro, you will need to review the Advanced Options in System Values.

5. Review your EU Courier Services

Review your EU Courier Services and ensure if you require an IOSS supported courier, that you have one, and you know which services need to be used for which countries.

- You will likely need to review your courier setups and delivery rates or review your courier on a per order basis until you have established suitable guidelines/rules for your operators.

- Each courier is handling IOSS differently.

- From the outset, we insist that customers liaise with their courier service provider for any shipments which are processed after the July transition across all of their channels. This will ensure information, references and charges are applying to your orders as you would expect. If not, you run the risk of you or your customers incurring unexpected charges beyond our control.

If you’re a Khaos Control or Khaos Control Cloud customer looking for further information, please get in touch or visit the following pages:

Khaos Control Cloud Customers Only

Sources: https://ec.europa.eu/taxation_customs/business/vat/vat-e-commerce_en